Long Term Investing Is About To Get Real

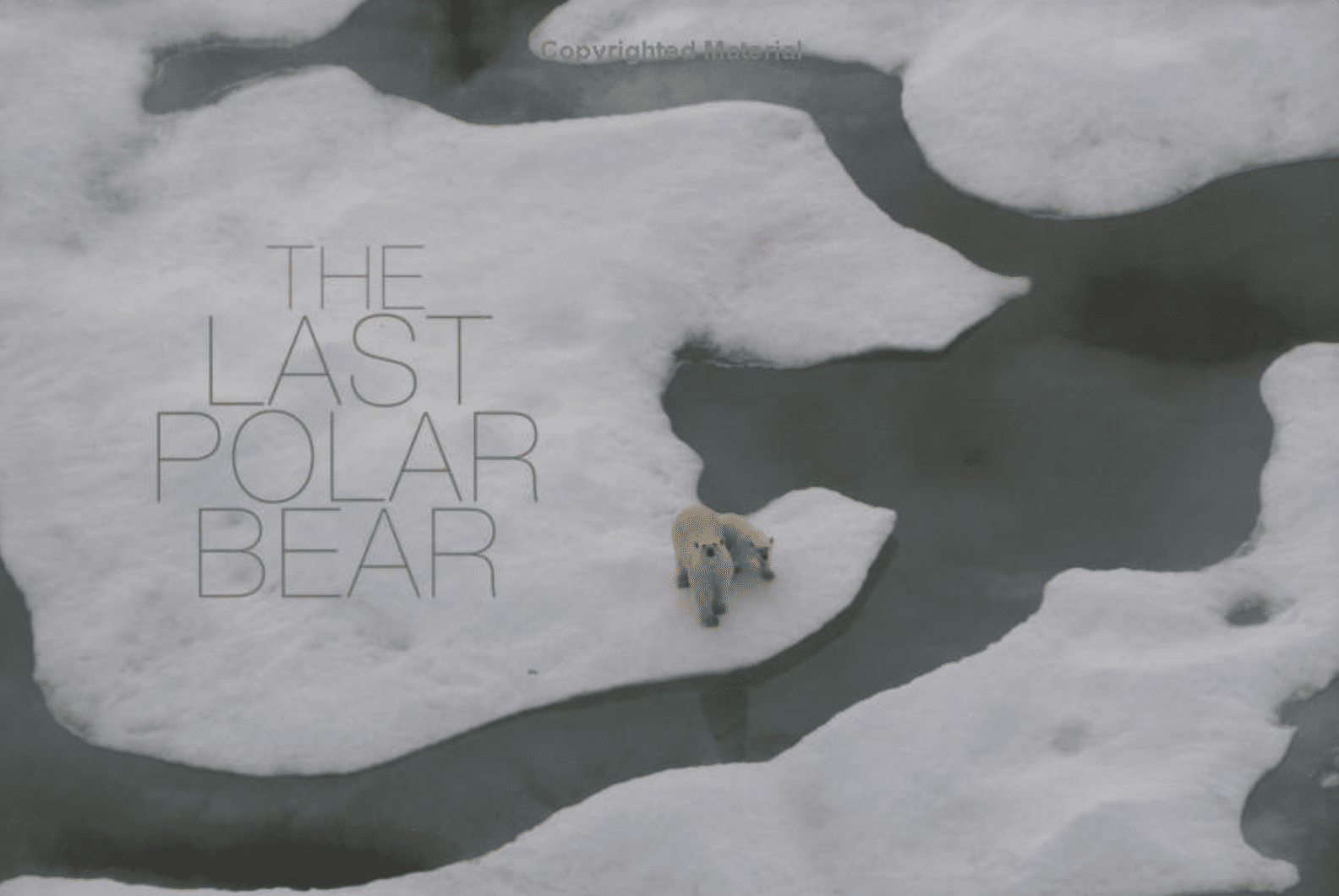

If you take more out than you put in, it will certainly fail. Whether it is our economy or an ecosystem, we need to invested in and take care of the very engine that keeps us going. So why is it that we treat our natural resources like a bank with infinite capital generation and keep taking money out of it sending it further into debt? If you over lever a person, a company or a country it will fail. This also true for any natural system.

However, if you manage a real asset, like a farm, a water system, a forest or a building for the long term, it will generate better returns and be of higher value year over year. This is Impact Investing. The impact you seek is one of continuous investment back into the asset so it will preform for the long term. Naturally, this includes the health of the community and environment.

If we look at the world and realize many resources are being mismanaged or are becoming scarce, it is not hard to see that there is a tremendous opportunity for value or wealth creation. If we can manage these resources so they are vibrant and sustainable for the long term, we can generate continuous yields for the long term and create great value. For example, if we harvest all of the world’s forests, we will generate an immediate profit but not have anything for tomorrow. On the other hand, if we harvest the forest sustainably so it is productive for generations to come, it can be a wonderful cash-yielding asset growing for the long term. If we could save the few remaining fisheries and harvest them sustainably then they, too, would generate outstanding returns and be very valuable. This is not so difficult to see.

With four billion more people who want to eat chicken and drive cars, and an emerging population that has the desire and the right to live as well as the other billions, we are putting the ultimate pressure on resources. Throughout the centuries people have wiped out (by fully harvesting) many irreplaceable resources and were forced to move. We have accelerated this in the past century; because of our highly advanced technologies and transportation systems have we been able to garner and deplete resources from far away places in order to maintain our lifestyle. This strategy will only lead to significant consequences for everyone.

There is a better way to invest in real assets by harvesting, recycling and keeping natural systems alive and thriving to generate continuous returns and value. We have spent the last five years looking at the fundamental resource building blocks of mankind and are finding the methodologies, systems, and people that can build sustainable thriving business that can sustain these resources, the environment and our own health. These systems are water, agriculture, energy, land, and housing. I am proud of both Bio-Logical Capital and Equilibrium Capital, who have been developing and delivering strategies and projects for investors to make incredible returns while doing the right thing.

Roland, Many thanks, I really appreciate this blog entry and your work at Bio-Logical and Equilibrium. Its encouraging to find other investors that are putting their money, expertise and time into such critical issues. We did after all not inherit this planet from our parents, we merely have it on loan from our children. Since 2007 we have focused our efforts almost entirely on this. We should create a global business alliance or holding company with similar firms in Europe, Asia, Middle East, you on the west coast and us on the East coast. Here is a quick intro: http://globalfundexchange.com/macro

Kind regards, Anric Blatt